Asset Management "Retirement"

When mention about retirement age, many people will think of the age of relaxation after working in company over 30 years. This age can take risks quite low because people in this age don’t have full time job and salary. So, there’s a question that be worth thinking about that how I should do to take care of myself after retirement and have stability before retirement.

Stability after retirement will be happened by financial planning for retirement early. The faster you start planning, the more advantage you get. Financial planning which we are going to mention is planning about investment and money saving to have asset and capital enough for make money after retirement. Types of financial planning for retirement have so many ways up to management of investment in assets such as cash, stocks, real estate, and bonds.

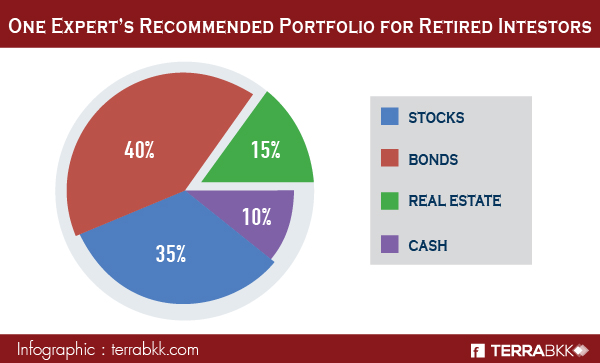

For investment in each type of asset, we must understand risks before invest. Retirement age must have a way of investment that different. Due to the study of John Spitzer, Ph.D. and Todd Houge, Ph.D., CFA (2012) from Lowa Center for Wealth Management, there’s example of investment port for retirement age that should have stocks 35%, bonds 40%, 15% real estate, and 10% cash according to graph below.

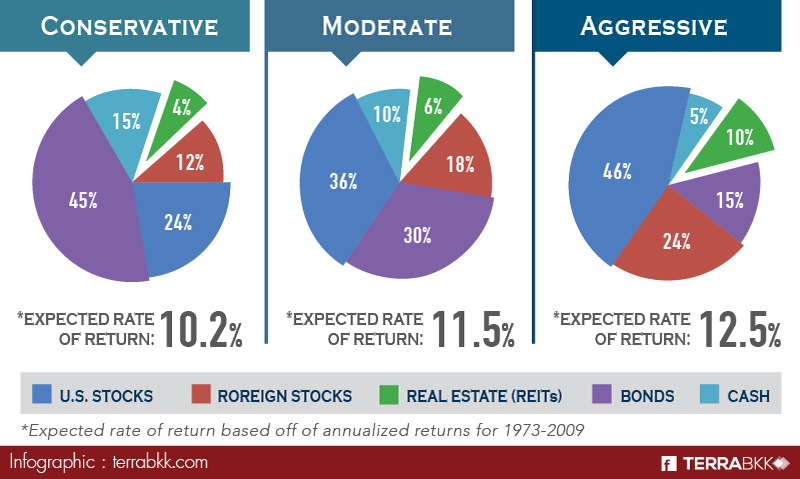

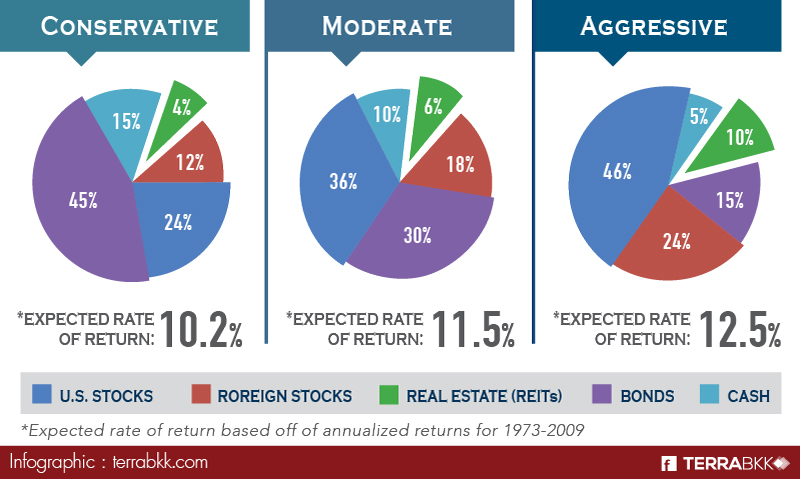

In United States, financial professors, Daniel C. Goldie (CFA, CFP) and Gordon S. Murray designed investment port for retirement age in proportion according to investment behavior of each person.

- Conservative : 24% U.S.Stocks, 12% Roregin stocks, 4% Real estate (REITs), 45% Bonds, 15% Cash

- Moderate : 36% U.S.Stocks, 18% Roregin stocks, 6% Real estate (REITs), 30% Bonds, 10% Cash

- Aggressive : 46% U.S.Stocks, 24% Roregin stocks, 10% Real estate (REITs), 15% Bonds, 5% Cash

Written on The Investment Answer book as picture below

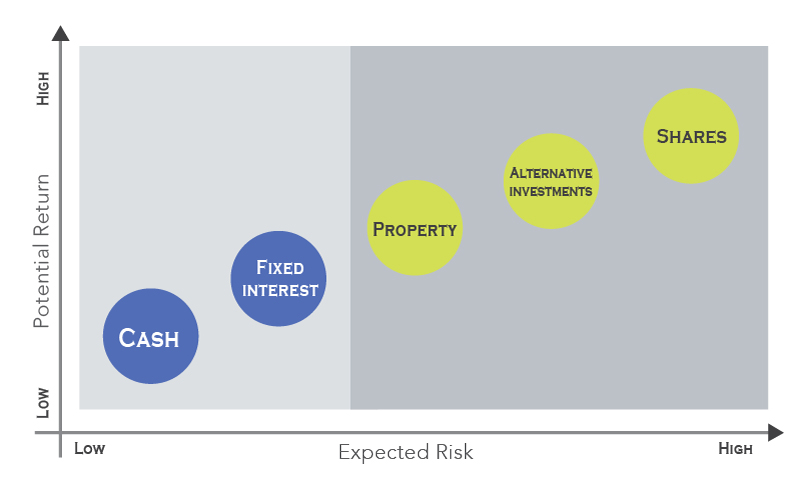

As we already know that investment in real estate has a lot of risks. You must have knowledge, skills moderately so that be successful in investment to spend a life during retirement age with financial stability and have readiness to enter retirement age completely in near future.