Case Study 4 : First Jobbers' Dream Stopped!, Being Condo Owner instead of Rent Apartment

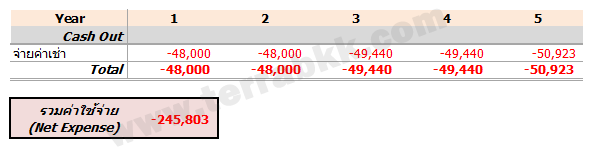

Many people said that, “The dream of First Jobber (starting work age), they are not only want to have their own car, but also want their own resident, personal space and to purchase a condominium is the highest dream of them. So, it makes many entrepreneurs start the condominium projects which have low price to penetrate the market of First Jobbers who are uncertain that they should rent an apartment or purchase cheap condominium. Today, TerraBKK Research has the answer for those who are undecided that which is worthier. In the mind of First Jobber who are renting apartment/condo, some is started question that, “If I take the money that I pay for rents pay installment in the same rate instead and get my own condo, live for a while and sell it, Is it better? Therefore, TerraBKK Research has a case study as example for you as follow: “Ms. Dreamer is 25 years old , rent an apartment in Bang Na 4,000 baht/month. Ms. Dreamer has an idea to buy her own condo but she will live for 5 years and then sell it because she moves her workplace. So, she considers 2 ideas as below: 1. Rent apartment/condo 4,000 Baht/month for 5 years by rents can increase 3% every 2 years. 2. Purchase pre-owned condo in the price of 1,000,000 Baht, pay installments for 30 years 4,700 baht/month and sell it on the 5th year in the price of 1,200,000 baht” Ms. Dreamer has to consider thoroughly both 2 choice as below: Choice 1: Rent apartment/condo 4,000 baht/month for 5 years by rents can increase 3% every 2 years.  According to above graph, if rent apartment/condo for 5 years, it will has total expenses 245,803 baht. Choice 2: Buy pre-owned condo 1,000,000 Baht and sell it on 5th year in the price of 1,200,000 baht. Have expenses as follow:

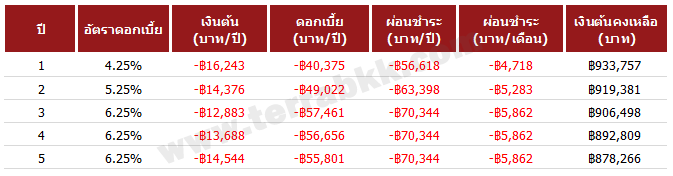

According to above graph, if rent apartment/condo for 5 years, it will has total expenses 245,803 baht. Choice 2: Buy pre-owned condo 1,000,000 Baht and sell it on 5th year in the price of 1,200,000 baht. Have expenses as follow:  And condition of installment rate as follow: Effective interest rate by MLR = 6.75% First year, MLR -2.5% interest = 4.25% 2nd year, MLR -1.5% interest = 5.25% From 3rd year, MLR -0.5% interest = 6.25% that has installment rate as follow:

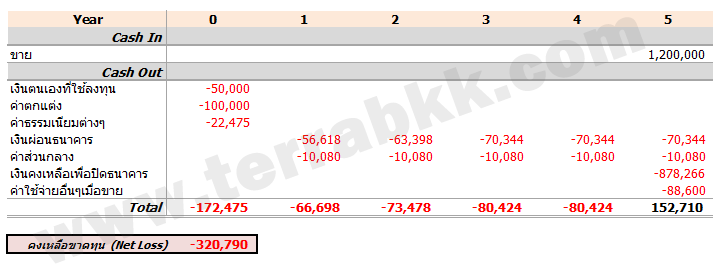

And condition of installment rate as follow: Effective interest rate by MLR = 6.75% First year, MLR -2.5% interest = 4.25% 2nd year, MLR -1.5% interest = 5.25% From 3rd year, MLR -0.5% interest = 6.25% that has installment rate as follow:  When take detail to consider annually, the result as follow:

When take detail to consider annually, the result as follow:  According to above graph, found that if buy condo 1,000,000 baht, live for 5 years and then sell it 1,200,000 baht, it will has total expenses 320,790 baht Difference between two choices Choice 1: Net expense 245,803 Baht Choice 2: Net loss (Net Loss) 320,790 Baht When consider both 2 choices already, you will found that purchasing condo and sell it within 5 years will make expenses more than renting. So, Ms. Dreamer should continue renting apartment/condo because purchase condo to live and sell it is not worthy for expenses of interest and fees. Although some case has promotion of transfer fee excepted or mortgage charge free, it does not helps you bear the expense burden so much. Therefore, deciding to purchase condo under these conditions isn’t better. Finally, TerraBKK Research recommend First Jobber who are looking for their own resident that, “Whether you buy brand new condo or pre-owned condo or other residents, you should think carefully. Every expense will happen during both buying and selling. Don’t decide to buy if you are not yet think carefully. More Case Study article >Case Study 9 : อสังหาฯของคุณ ทรัพย์สิน หรือ หนี้สิน กันแน่ ? >Case Study 8 : สำหรับ First Jobber คิดอย่างไรให้การซื้อคอนโดคุ้มกว่าการเช่า? >Case Study 7 : เหตุผลที่คนรวยซื้ออสังหาฯ >Case Study 6 : Cut Loss !! ตัดใจขายทิ้ง เมื่อเก็บอสังหาฯไว้ มีแต่รายจ่าย >Case Study 5 : รายได้เท่าเดิม อยากซื้ออสังหาริมทรัพย์ที่แพงกว่า ควรทำอย่างไร ? >Case Study 3 : "เช่าซื้อบ้าน" ทางออกของผู้มีรายได้น้อย >Case Study 2 : ซื้อบ้านเพื่ออยู่อาศัย ควรขอสินเชื่ออย่างไร ? >Case Study 1 : ลงทุนอสังหา ต้องกู้สินเชื่ออย่างไร ?

According to above graph, found that if buy condo 1,000,000 baht, live for 5 years and then sell it 1,200,000 baht, it will has total expenses 320,790 baht Difference between two choices Choice 1: Net expense 245,803 Baht Choice 2: Net loss (Net Loss) 320,790 Baht When consider both 2 choices already, you will found that purchasing condo and sell it within 5 years will make expenses more than renting. So, Ms. Dreamer should continue renting apartment/condo because purchase condo to live and sell it is not worthy for expenses of interest and fees. Although some case has promotion of transfer fee excepted or mortgage charge free, it does not helps you bear the expense burden so much. Therefore, deciding to purchase condo under these conditions isn’t better. Finally, TerraBKK Research recommend First Jobber who are looking for their own resident that, “Whether you buy brand new condo or pre-owned condo or other residents, you should think carefully. Every expense will happen during both buying and selling. Don’t decide to buy if you are not yet think carefully. More Case Study article >Case Study 9 : อสังหาฯของคุณ ทรัพย์สิน หรือ หนี้สิน กันแน่ ? >Case Study 8 : สำหรับ First Jobber คิดอย่างไรให้การซื้อคอนโดคุ้มกว่าการเช่า? >Case Study 7 : เหตุผลที่คนรวยซื้ออสังหาฯ >Case Study 6 : Cut Loss !! ตัดใจขายทิ้ง เมื่อเก็บอสังหาฯไว้ มีแต่รายจ่าย >Case Study 5 : รายได้เท่าเดิม อยากซื้ออสังหาริมทรัพย์ที่แพงกว่า ควรทำอย่างไร ? >Case Study 3 : "เช่าซื้อบ้าน" ทางออกของผู้มีรายได้น้อย >Case Study 2 : ซื้อบ้านเพื่ออยู่อาศัย ควรขอสินเชื่ออย่างไร ? >Case Study 1 : ลงทุนอสังหา ต้องกู้สินเชื่ออย่างไร ?