Case Study 2 : What way is better to apply loans for purchasing house ?

In the present, in the case that you want to purchase new house with a limited capital, if you wait and collect money until you can buy them without borrowing, it will take a very long time and your wished house will be more expensive til you can't possess it. So, to apply loan from bank is the necessary thing.

Purchasing house for living is the one type of investments that cause property but not cause income (rents). Financial capital in the form of interest will is the main factor that everybody pays attention but it’s not enough if you ignore other related factors. Generally, banks will lend in the loan amount not over 80% of appraised price or selling price (in the case of bank’s promotion, loan amount might be higher) and burden of installment paying should not more than 40% of salary. This condition is the important terms that banks consider to calculate monthly installment rate and loan term. In the case of low income person, installment rate will lower by increase loan term to make it longer maximum not over 30 years. This point will affect directly to interest summation and will be the main factor that makes this loan repayment summation higher than house's actual price so much.

TerraBKK Research is going to explain simply by sample situation that possible to happen in real life as follow

(All are assumed numbers that may differ from real)

"Mr. Joe is 30 years old, income 52,000 Baht/month, want to purchase new house for living in the price of 3.5 MB in area of Nonthaburi and apply a loan from bank in the amount of 2.8 MB (80% of home price) with effective rate throughout loan term at MLR-0.5% (6.25%). Mr. Joe is interested and has studied 2 ways of installment as follow:

1. 20 years plan that maximum installment rate up to ability to pay installment

2. 30 years plan to reduce the burden of monthly installment to make it lowest "

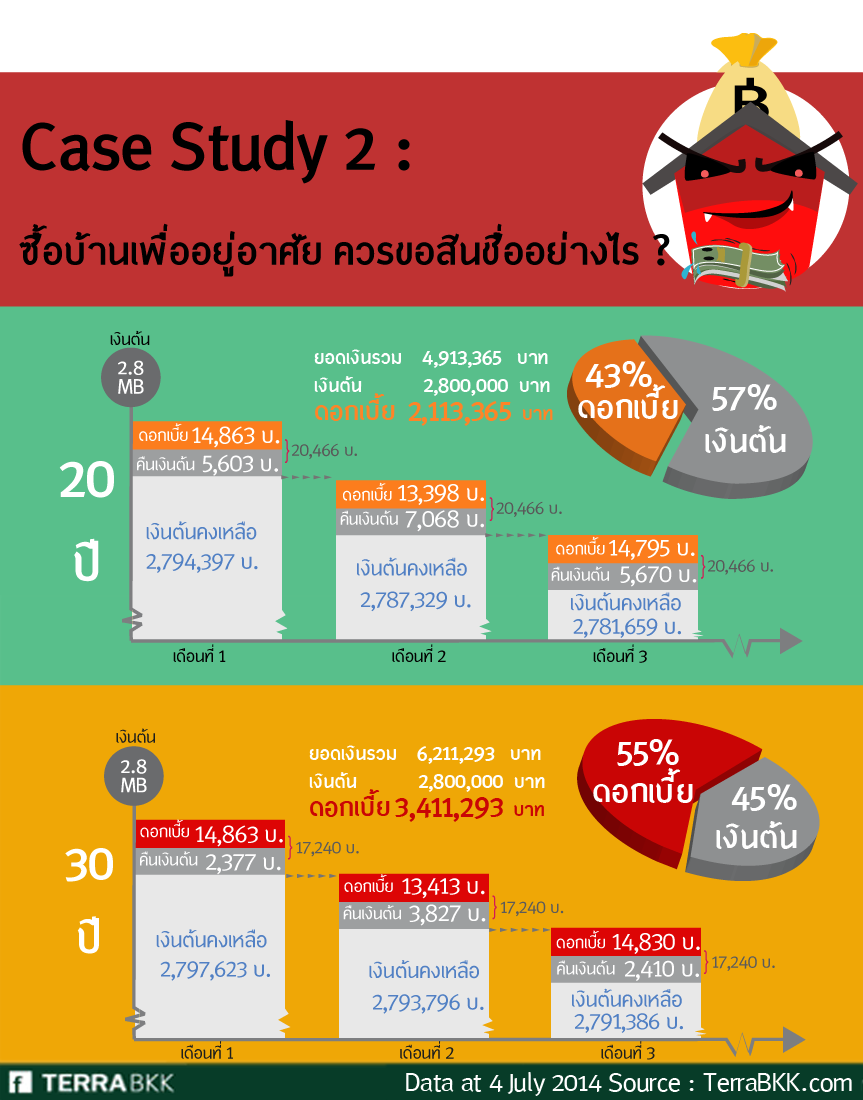

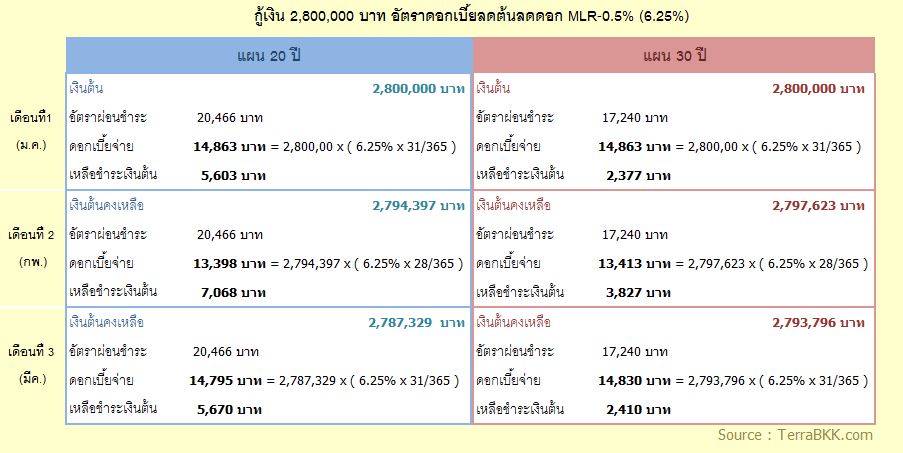

Mr. Joe has the ability to pay installment at 40% of income or about 20,800 baht baht and according to basic calculation found that 20 years plan has installment rate at 20,456 baht/month whereas 30 years plan has installment rate at 17,240 baht/month which are not different so much. But if you study the details to ratio between interest and capital on first 3 months of installment, you will find information as the chart below.

TerraBKK Research is going to say that installment rate decreased when increases loan term because of decreasing only capital. You will be noticed that net capital of 30 years plan will decrease almost half of 20 years plan whereas interests are almost same because monthly installment rate is the summation of capital and interest. Making loan term to be longer will make capital will be split. So, monthly installment cannot reduce remaining capital so much whereas interest calculation will calculate from remaining capital. It will make you pay more interest due to increased loan term.

When you look overview throughout loan term, found that 20 years plan has interest ratio 75% of capital ( = 2,113,365 / 2,800,000 ) whereas 30 years plan has interest ratio up to 122% of capital ( = 3,411,293 / 2,800,000), difference more than million baht ( = 3,411,293 -2,113,365 ).

Finally, TerraBKK Research recommend that to apply loan from bank might be the biggest debt of the life that you have to take a very long time to clear off this debt. So, if borrowers choose installment rate that take a shorter time, it will be better choice. However, it’s up to ability to pay installment. Low income persons may choose installment rate by ability to pay installment. If they have more income, they will contact to banks to increase monthly income rate. It is one of ways that make loan term shorter to make you be a homeowner sooner.

Calculate loan at โปรแกรมคำนวณสินเชื่อ

More Case studies

>Case Study 9 : อสังหาฯของคุณ ทรัพย์สิน หรือ หนี้สิน กันแน่ ?

>Case Study 8 : สำหรับ First Jobber คิดอย่างไรให้การซื้อคอนโดคุ้มกว่าการเช่า?

>Case Study 7 : เหตุผลที่คนรวยซื้ออสังหาฯ

>Case Study 6 : Cut Loss !! ตัดใจขายทิ้ง เมื่อเก็บอสังหาฯไว้ มีแต่รายจ่าย

>Case Study 5 : รายได้เท่าเดิม อยากซื้ออสังหาริมทรัพย์ที่แพงกว่า ควรทำอย่างไร ?

>Case Study 4 : ดับฝัน! First Jobber เป็นเจ้าของคอนโดฯแทนเช่าหอพัก

>Case Study 3 : "เช่าซื้อบ้าน" ทางออกของผู้มีรายได้น้อย

>Case Study 1 : ลงทุนอสังหา ต้องกู้สินเชื่ออย่างไร ?